REMES

Remes

Computable General Equilibrium model that represents a national economy with a particular focus on the energy system.

Introduction

REMES is a Computable General Equilibrium model that represents the Norwegian economy with a particular focus on the energy system. REMES is used to study the effects of macroeconomic policies on the Norwegian economy.

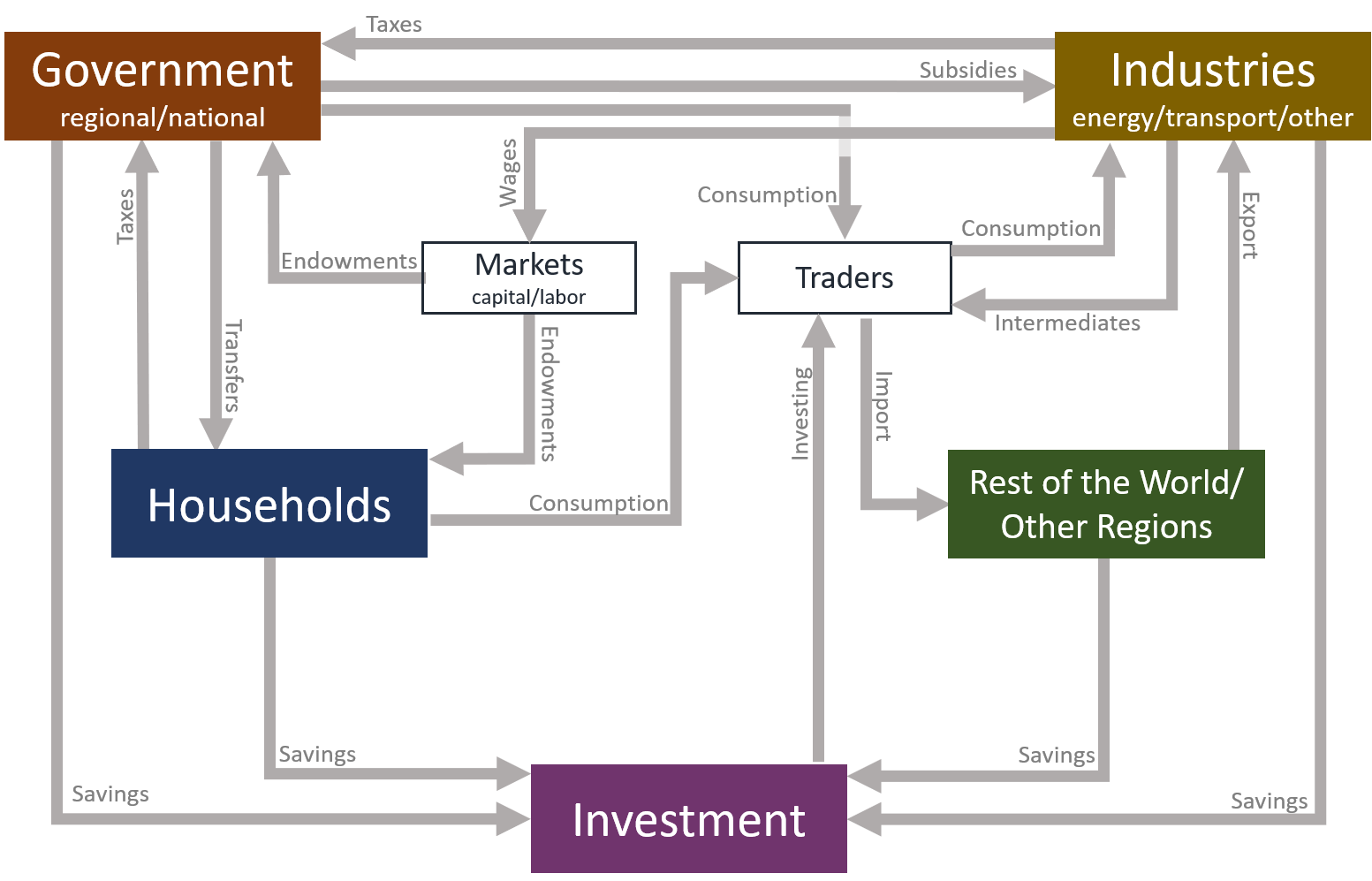

The model splits the national economy into five regions, which coincide with the five Norwegian energy market zonal prices. It includes 36 production sectors and 32 products and considers demand from households, investors and government alongside international imports and exports. . Policies are modeled as shocks, which influence the economy by means of taxes or subsidies. Effects are considered on prices, activity levels exports, imports and technology changes. The structural interconnections between the main building blocks in the model are displayed in Figure 1, where the arrows illustrate the payments direction between the elements of the model.

Figure 1. REMES model main elements

REMES has been developed as a static, a recursive dynamic and a forward-looking dynamic model. Many analyses can be carried out using the static model by computing the effects of counterfactual policies, which assume the role of what-if analyses, simulating the state of the economy at the end of the considered horizon. It is also possible to perform such analyses with a single period resolution and use the results of the model as a starting point for computing the equilibrium in the next period in a recursive fashion. The (forward-looking) dynamic version considers households capable of evaluating the returns of capital and decide how much of their monetary endowments to be allocated for consumption and for investment. This allows defining the evolution of the capital and therefore the level of prices and production over time. Each version of REMES provides as result a new economic equilibrium for every considered period in the simulation horizon, displaying information on level of activities from all the sectors, price for commodities and production factors, demand level, level of imports and exports.

Mathematical Formulation and Implementations

The mathematical formulation of REMES is based on the concept of Arrow-Debreu macroeconomic equilibrium structured in complementarity format. The complementarity format allows structuring an equilibrium in the form of weak inequalities, by establishing a logical connection between prices and market conditions.

A competitive equilibrium between all markets is described as a vector of activity levels, a vector of prices and a vector of total income, fulfilling the following conditions:

REMES considers five types of variables:

- Price related to anything that can be exchanged in the economy;

- Activity levels which measure how much a sector or actor in the economy converts input factors into products or utility

- Budget which is held by households and government and is related to their capacity of monetizing resources and must be equal to the sum of their expenditure and savings

- Control variables which scale taxes, subsidies and other transfers according to predefined conditions, in order to suggest policies to reach a predefined goal.

The main input data is structured as a Social Accounting Matrix (SAM), describing all the monetary flows between the different agents and sectors in a given base year. Moreover, each sector is endowed with a set of parameters, called elasticities of substitution, defining the responsiveness of the sectoral input mix (products, services, commodities, labor and capital) to change in factors prices. Each of the five regions is characterized by having its own SAM that contains the amounts of all the exchanges between sectors, products and actors in the model. Goods and services are exchanged both internally in the region and outside the region, through a trade field for each product or service in each SAM. The figures in these fields represent exports from the region and they must be distinguished between the value that remains inside the country and the value directed abroad. A specialized matrix keeps track of the export direction. This trade matrix links the regional SAMs together. Norway has a large production of oil and gas from the continental shelf, with high production, no households and highly specialized transport needs. We have chosen to attach the continental shelf to region 5 (Vestlandet), and the reason is that the main offices of the activities on the continental shelf are in this region.

Implementation

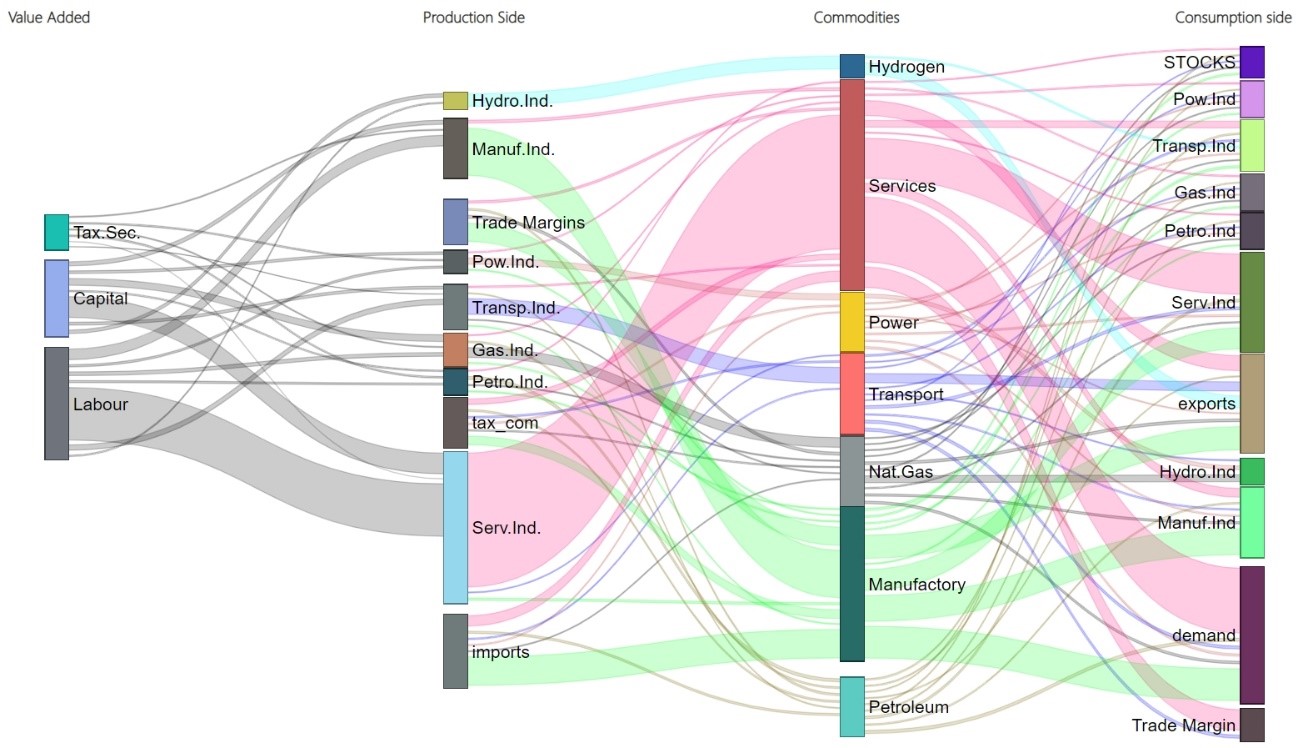

REMES provides economic simulations of possible scenarios resulting from the implementation of different kinds of policies as well as their impact on different sectorial activity levels and prices, also considering assumptions of the future state of technology and consumption trends. Typically, the main output takes the form of the evolution of value added in different sectors and regions, the composition value for inputs and outputs for each sector and the monetary flows between different actors and sectors in the economy. Figures 2 and 3 give a visual representation of such exchanges. Namely, the diagram in figure 2 depicts the exchanges of goods in the Norwegian economy stemming from the data in the SAM. The data represents the exchanges in 2007. Figure 3 depicts the simulation of a phase out of the oil sector, whose exports will drastically diminish, while hydrogen produced by electrolysis and natural gas operate as a backstop technology to replace oil in the exports. The scenario also assumes a transition of part of the transport sector from conventional fuels to hydrogen. Insights provided by the REMES model are used in the Norwegian Energy Roadmap project and in the SET-Nav1 project, its general description can be found in Werner et al. (2017)2 and results stemming from its application in the study of the transition of the Norwegian transport sector to hydrogen are published in Helgesen et al (2018)3.

Figure 3. Simulation of the monetary flows in the Norwegian economy in 2050

Projects

|

SET-Nav |

Reference

- Set Nav Report

- Egging, R. & Ivanova, O. (2018). Regional policy and the role of interregional trade data: policy simulations with a model for Norway. Regional Studies, Regional Science Volume 5, 2017 - Issue 1

- Werner, A., Pérez-Valdés, G. A., Johansen, U., & Stokka, A. (2017). REMES-a regional equilibrium model for Norway with focus on the energy system. SINTEF Rapport.

- Helgesen, Per Ivar; Lind, Arne; Ivanova, Olga; Tomasgard, Asgeir. (2018) Using a hybrid hard linked model to analyze reduced climate gas emissions from transport. Energy. vol. 156.